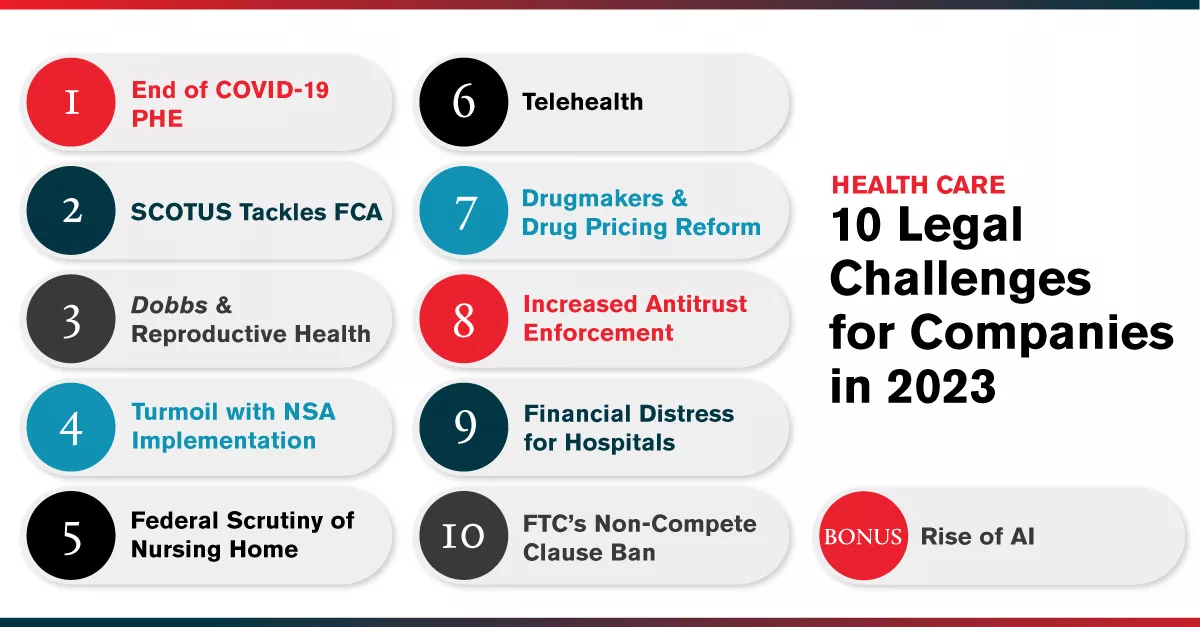

10 Legal Challenges for the Health Care Industry in 2023

With the new year underway, the ArentFox Schiff Health Care team highlights 10 of the most pressing legal issues facing the industry in 2023.

- End of the COVID-19 Public Health Emergency. After being in effect for more than three years, the US Department of Health and Human Services’ (HHS) declaration of a national public health emergency (PHE) regarding the COVID-19 pandemic will finally come to an end. The decision to terminate the PHE was first revealed in a January 30, 2023 policy statement by the Biden Administration’s Office of Management and Budget and was later confirmed in a letter that HHS Secretary Xavier Becerra sent to state governors on February 9, 2023. According to Secretary Becerra’s letter, the PHE will persist through May 11, 2023, and not be further renewed thereafter. As we have previously reported, numerous federal health policies, ranging from waivers of certain provisions of the Stark Law to relaxed enforcement of HIPAA privacy and security requirements for telehealth, are tied to the PHE and will terminate when the PHE terminates. Over the coming months, health care providers should assess how they have relied on the PHE’s regulatory flexibilities and how they will navigate the post-pandemic terrain once the PHE ceases.

- The Supreme Court Tackles the False Claims Act. No federal statute brings greater anxiety to the health care industry than the False Claims Act (FCA), with its treble damages, civil penalties, and enormous investigation and litigation costs. As previously discussed here, the US Supreme Court will address the “knowing” standard and whether multiple reasonable interpretations of a statute or regulation precludes FCA liability. Relators’ counsel contends there is a circuit split and a defendant’s subjective understanding that he or she is violating the law should meet the “knowing” standard under the FCA, even when the legal standard is ambiguous. Defense counsel counters that the FCA’s scienter requirement is not met when there are reasonable interpretations of a legal obligation. The US Department of Justice (DOJ) has weighed in on the side of the relators, arguing that defendant’s state of mind when submitting the claim matters and the identification of “wrong-but-reasonable justifications after the fact” should not allow persons to escape FCA liability. Oral arguments are set for April 18, 2023. Stay tuned.

- Dobbs and Reproductive Health. Following the June 2022 Supreme Court decision in Dobbs v. Jackson Women’s Health Organization, to overturn Roe v. Wade, the legal landscape related to reproductive health continues to evolve, particularly in states that have implemented abortion restrictions previously prohibited by Roe. Where a federal right once existed, there is now a 50-state patchwork of laws related to surgical and medication abortions and reproductive health that impact health care providers and employers alike. Many of these laws are subject to litigation which can result in temporary enforcement bans. In addition, in several states, ballot initiatives have or will be put to voters. Thus far, the adopted ballot initiatives have ended in favor of protecting reproductive health rights. The ArentFox Schiff Reproductive Health Task Force is closely tracking the development of new abortion laws, the implementation of existing laws, and future ballot initiatives as well as other developments involving other reproductive health issues such as personhood laws and access to contraception.

- Turmoil with Implementation of the No Surprises Act. Federal litigation concerning the No Surprises Act (NSA) is increasing uncertainty for payers and health care providers. On February 10, 2023, HHS announced a temporary halt to reimbursement decisions under the NSA pending review of a court ruling that vacated significant portions of the implementing regulations. The ruling held that the regulations governing Independent Dispute Resolution (IDR) between providers and payers for reimbursement of out-of-network services unfairly favored payers by giving undue weight to the Qualifying Payment Amount (QPA), the in-network rate calculated by payers. HHS has instructed IDR entities not to issue any new payment determinations, and to “recall” any determinations made after February 6, 2023, while HHS and the other federal agencies decide how to “comply with the court’s order.” In addition, physician groups have challenged regulations regarding calculation of the QPA, as well as CMS’s recent sevenfold increase in nonrefundable IDR administrative fees. Even before the recent HHS notice halting reimbursement decisions, IDR entities were swamped with significantly more IDR requests than anticipated, resulting in a backlog of cases and delays in payments. There appears to be no resolution in sight. ArentFox Schiff remains active in the pending litigations, as well as in representing health care providers in the IDR process.

- Enhanced Federal Scrutiny of the Nursing Home Industry. The nursing home industry faced great scrutiny from the Biden Administration and Centers for Medicare & Medicaid Services (CMS) in 2022 in the wake of COVID-19. This scrutiny will continue into 2023. The Biden Administration’s focus has been to ensure that nursing homes have sufficiently trained staff; poorly performing nursing homes are held accountable; and the public is informed about nursing home conditions. In October 2022, CMS revamped its Special Focus Facility (SFF) program, which oversees nursing homes with significant histories of non-compliance, to address facilities remaining in the SFF program for too long or that regress after graduating. The impact of these program changes is expected to be felt this year. CMS also just released a proposed rule that would require disclosure of additional ownership and management information of nursing homes, including whether nursing home owners are private equity investors and real estate investment trusts. CMS will undoubtedly continue to release initiatives targeting nursing home quality of care and compliance this year.

- Telehealth: An Open Landscape. Use of telehealth and other digital health modalities increased dramatically over the course of the PHE due, in part, to statutory and regulatory waivers of certain pre-existing telehealth requirements that were barriers to adoption. The waivers ensured coverage for telehealth services provided to patients in their homes and urban areas, broadened the scope of practitioners that could bill for telehealth services, and authorized the use of audio-only technology as a reimbursable treatment modality. The telehealth waivers are scheduled to expire 151 days after the federal PHE ends. Now, as that date draws closer, regulators are wrestling with how to maintain appropriate access to telehealth services in the post-PHE world. Other issues relating to provider licensing and the treatment of patients across state lines will likely be areas of focus in 2023 as well. We predict Big Tech’s increasing interest in telehealth, and Meta’s entry into the Metaverse, will lead to increased corporate growth, deal flow, and innovation in the industry.

- Pharmaceutical Manufacturers and Drug Pricing Reform. The Inflation Reduction Act (IRA) was passed into law on August 16, 2022 with wide bi-partisan support. The drug pricing reform section of the IRA represents a sweeping change with respect to how the Medicare program will pay for prescription drugs in the future. The law also features significant Medicare Part D benefit design changes that will directly benefit Medicare patients at the pharmacy counter. Part of the IRA went into effect in January 2023 (specifically, the $35 cap on insulin costs for Medicare patients, the new requirement for drug manufacturers to pay Medicare rebates if certain drug prices rise faster than inflation, and the elimination of all cost sharing and deductibles under Part D for vaccines). The remainder of the IRA drug pricing provisions will be phased in by 2029. One “issue to watch” for 2023 is how Medicare will negotiate a “maximum fair price” directly with manufacturers for the most expensive drugs covered under Medicare Part B and Medicare Part D. The industry can expect issuance of guidance documents and proposed regulations concerning the specific parameters of how drugs are selected for negotiation, the negotiation process itself, and related issues. Finally, the industry can expect guidance related to the new inflation-based rebates. CMS has already published guidance, fact sheets and frequently asked questions on a new web page dedicated to all things IRA and Medicare, found here: Inflation Reduction Act and Medicare | CMS.

- Increased Antitrust Enforcement in the Health Industry. The DOJ and Federal Trade Commission (FTC) have been aggressively pursuing the application of the antitrust laws to the health care sector, and companies are heeding that warning by revisiting their antitrust compliance programs. The latest salvo from the government came on February 2, 2023, when the DOJ announced the withdrawal of three policy statements on information exchanges that have been the backbone of antitrust compliance programs in the health care industry for nearly 30 years: Antitrust Enforcement Policy Statements in the Health Care Area (1993), Statements of Antitrust Enforcement Policy in Health Care (1996), and Statement of Antitrust Enforcement Policy Regarding Accountable Care Organizations Participating in the Medicare Shared Savings Program (2011). In withdrawing those policy statements, the DOJ stated that the antitrust “safety zones” in those policies may not reflect the reality that the health care industry has become more consolidated over time, and developments in technological tools such as data aggregation, machine learning, and pricing algorithms have increased the competitive value of information. This has prompted many industry participants to consider refreshing their policies and procedures for antitrust compliance and taking a look at the risk profile of their activities.

- Financial Distress for Hospitals and Other Providers. Large health sector bankruptcies rose dramatically in 2022, bringing the sector back to pre-pandemic Chapter 11 filing levels. While these filings were concentrated in the pharmaceutical and senior care markets, the 2023 outlook for hospitals shows negative projections on both the expense and revenue sides, with labor costs a continued source of pressure. A fall 2022 report commissioned by the American Hospital Association (AHA) contains a number of startling findings, including projected negative margins for over half of US hospitals. Over 600 rural hospitals—about 30% of all such hospitals—are at risk of closing. This financial distress appears to be more fundamental than short-term expense increases, and may reflect sustained systemic challenges associated with the continued shift toward outpatient, in-home and value-based care, along with post-acute care shortages that are resulting in inpatient discharge delays. For health sector clients, it will be important to anticipate financial headwinds in 2023, and to take proactive measures to ensure appropriate governance and executive action. This financial management plan may include review of financial covenants, contingency planning for organizational financial stress, and sustained attention to both labor and other expenses as well as revenue generation opportunities. For many health care organizations, robust strategic planning will be in order, including merger, acquisition and joint venture activity, targeted downsizing, longer-term workforce approaches, and expanded in-home and post-acute care opportunities. And for those in severe financial distress, it may be appropriate to explore Chapter 11 filing or other forms of debtor relief. Of course, any financial management plan will need to be compliant with federal and state law related to licensure, Medicare/Medicaid certification, employee rights, bankruptcy, and antitrust laws and to recognize that the FTC is scrutinizing the health sector.

- The FTC’s Non-Compete Clause Ban and Impact on Health Care. In January 2023, FTC proposed a new rule that would ban employers from imposing non-competes on their workers and require employers to rescind existing non-competes. As we previously reported, the FTC is seeking public comment on the proposed rule through March 20, 2023. We think it is likely that employers will challenge the rulemaking. If the proposed rule goes into effect, it could have a significant impact on health care providers, such as hospitals, surgery centers, physician practices and others, that routinely use non-competes in their operations. Importantly, non-profit entities, such as non-profit health systems, are generally exempt from the FTC Act and thus would not be subject to the new rule. It will also be interesting to see if the FTC’s proposed rule causes more states to limit the enforceability of non-competes or further restrict their existing bans.

Special Bonus: The Rise of AI in Health Care. Lastly, we anticipate artificial intelligence (AI) will continue making significant gains in health care in 2023. In just the past four years alone, the US Food & Drug Administration approved hundreds of the more than 520 medical algorithms that were market cleared as of January 2023. Yet, for all the transformative possibilities of AI in health care, signs were evident in 2022 that many health policymakers and regulators are worried about AI’s unintended consequences. For example, in December 2022, the HHS Office for Civil Rights (OCR) issued a bulletin to caution that because of the proliferation of tracking technologies, such as AI-driven Google Analytics and Meta Pixel, collecting sensitive information, “now more than ever, it is critical for regulated entities to ensure that they disclose [protected health information] only as expressly permitted or required by the HIPAA Privacy Rule.” This bulletin followed a new regulation that OCR proposed earlier in 2022 explicitly prohibiting health care providers enrolled in Medicare from discriminating based on race, sex, and other protected characteristics “through the use of clinical algorithms in [their] decision-making.” Meanwhile, similar regulatory oversight actions are beginning to occur at the state level. In California, for instance, the Attorney General initiated an ongoing probe into how algorithmic tools are exacerbating racial and ethnic disparities. As calls for more oversight continue in 2023, health care providers should proactively monitor and assess their AI technology practices and their potential impacts on disadvantaged patient populations.

Contacts

- Related Industries