Don’t Walk Under That Mistletoe: Limited Liability for Agritourism Destinations

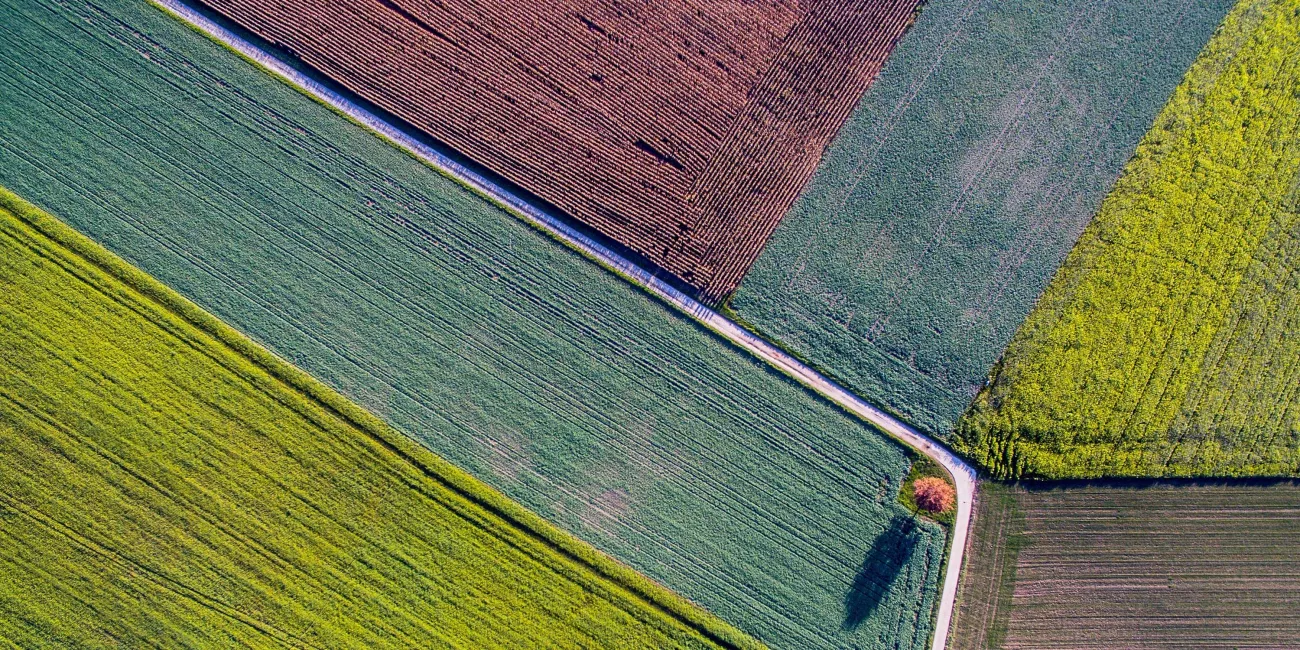

‘Tis the season for many Americans to head out to a local Christmas tree farm. But what if in the course of picking out the perfect tree, someone twists their ankle out in the fields, a tree being felled falls on a caroler, or a car gets dented while the tree is being loaded in? It’s this type of risk that often makes agritourism destinations worried about opening up their properties to consumers.

While agritourism destinations will often carry some sort of premises liability insurance policy that covers day-to-day injuries, additional insurance for agritourism-related activities can be expensive. At the same time, agritourism can be a lucrative additional revenue stream for operators. Between 2012 and 2017, the revenue generated by farm-related agritourism alone tripled, and many states have sought to nurture the industry. At least 39 states have enacted statutes limiting the liability for agritourism destinations, usually for activities that are considered “inherent risks of agritourism” and provided that proper signage and notice is given to potential agritourists.

Below, we take a tour of the current agritourism landscape, survey the various types of limited liability statutes in the agritourism space, and flag some future agritourism activity to keep an eye on.

Agritourism In A Nutshell

There is no set definition of agritourism, but the US Department of Agriculture (USDA) generally describes it as a “commercial enterprise that links agriculture production and processing with tourism to attract visitors onto a farm, ranch, or other agricultural business for the purposes of entertaining or educating the visitors while generating income for the farm, ranch, or business owner. Classic examples of agritourism destinations include not just Christmas tree farms, but also pumpkin patches, u-pick berry farms, and dude ranches.

Different states and organizations, however, define agritourism differently and there are many activities that may be included in one state’s definition that are excluded in another’s.[1] For example, certain farmers’ markets are explicitly included in Alabama’s definition of agritourism, but not in neighboring Tennessee’s. And a Virginia winery’s property line better not cross state borders, because wineries are included in Virginia’s definition of agritourism, but not North Carolina’s. In addition, agritourism destinations may also host other activities that may or may not fall into traditionally-recognized categories of agritourism, such as event and wedding barns, or even goat yoga.

Limiting Liability for Agritourism Providers

Agritourism has historically been an industry that exposes operators to additional types of liability risk. Agritourism activities — such as hayrides — aren’t always typical farm activities, and consumers often have less familiarity engaging in those activities.

A patchwork of different statutes offer a variety of liability protection for agritourism operators. First, equine immunity laws provide some liability protection for operators offering equine-related activities. Second, “u-pick” immunity laws also offer similar protections for pick-your-own produce operations. Third, recreational user immunity laws protect some operators against consumers at the property for recreational purposes; though these statutes usually require the protected recreational activity to be free-of-charge. Fourth, some states, like Illinois, have provided for liability insurance tax credits to go toward liability insurance premiums.

Since 2004, states have also begun enacting legislation that generally limits liability specifically for agritourism destinations. These statutes typically have three parts:

- Limited liability if the injury is sustained from an “inherent risk” of the agritourism activity.

Whether the agritourism activity will fall within the protection of the liability statute will depend on each state’s definition of “agritourism.” The same goes for what an “inherent risk” of an agritourism activity is. Typically, this includes the condition of the land/water surfaces, wild and domesticated animals, structures and/or equipment ordinarily used in the agricultural business, and the negligent acts of the consumer.

- Appropriate safeguards — such as statutorily mandated warning and notice signs — must be taken for the statute’s protections to apply.

Liability statutes will also often contain requirements for operators to comply with to qualify for the liability protection. Most often the statutes will require specific warning language to be used for on-property signage and/or in contracts and waivers. Some statutes also require operators to register as agritourism businesses with the state.

- The injury does not fall into a statutory exception.

Most liability statutes will also provide exceptions to the liability protection for injuries that result from the operator’s own negligence or if the operator had actual knowledge or reasonably should have known of the dangerous condition that caused the injury.

What’s Ahead?

The trend tends toward more states passing agritourism limited liability statutes. But, the trend hasn’t always played out. In Illinois, the agritourism limited liability statute has been introduced to the state legislature twice but not been voted on. Currently, it’s assigned to a “session sine die,” meaning there isn’t a day set for the bill to be reconsidered. The Illinois liability insurance tax credit legislation, passed in spring 2022, may be seen as a compromise or temporary stopgap, until the full liability legislation can be voted on.

At the federal level, in January 2022, a bipartisan bill, the “Accelerating the Growth of Rural Innovation and Tourism Opportunities to Uphold Rural Industries and Sustainable Marketplaces (AGRITOURISM) Act,” was introduced in the US House. The Act would create an Office of Agritourism under the USDA’s umbrella to promote agritourism activities and businesses. The bill has not yet been voted on.

Individual operators should take a close at the regulatory scheme in place in their particular states. Please reach out to any member of AFS’s Consumer Products Group if you would like to discuss how these issues might impact your operations.

[1] Id.

Contacts

- Related Industries

- Related Practices